LINK TO ORIGINAL ARTICLE: https://www.smallcapinvestor.ca/post/a-guide-to-relative-valuation-jnh-doc-well

What is ‘relative valuation’?

Relative valuation is the notion of comparing the price of a company to the market value of similar companies.

To do this we need to use relevant multiples (P/E, EV/SALES, EV/EBITDA, etc.).

The multiples used in a relative valuation model must be a relevant proxy for a company’s value. For example, we cannot compare the average age of employees of different companies to determine their value, that would make no sense. We need to use metrics that are directly associated with a company’s intrinsic value, such as: sales, market cap, net income, and many others. Also, the companies we are comparing MUST BE RELATED in terms of industry and business operations.

For example, you cannot compare CloudMD or WELL Health Technologies to a cannabis company or a gold mining company. That is the same as comparing apples to oranges and your analysis would be useless.

Let’s start with an example: a relative valuation of CloudMD….

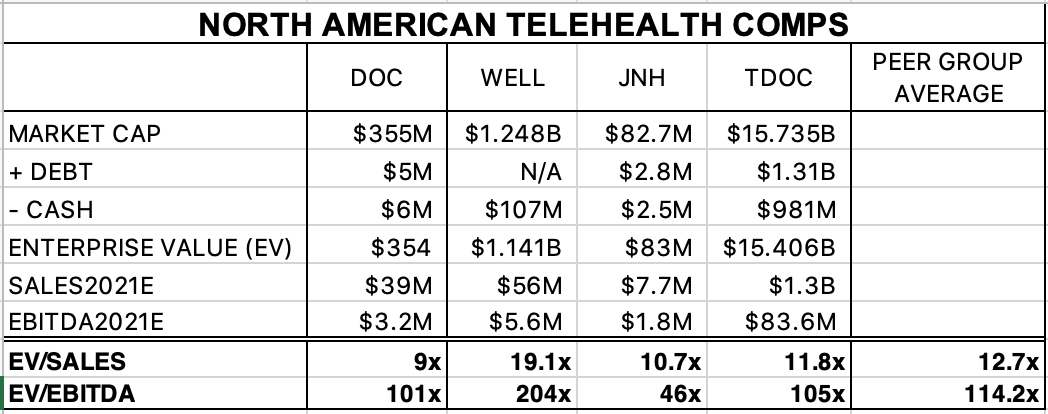

In order to do this, we need to also analyze other similar companies, such as: WELL, JNH, and TDOC.

So what are some relevant metrics we could use to determine value of these companies?

Well let’s start with the market cap, which is basically the total market value of the company. But market cap does not account for any debt or cash that the company has. So a better representation would actually be Enterprise Value (EV).

To calculate Enterprise Value, the formula is: EV = MARKET CAP + DEBT - CASH.

Enterprise Value is essentially what it would cost to acquire the company, assuming the acquirer also takes over any debt obligations as well as any cash. That is why we subtract cash and add debt from market cap in the formula.

It seems confusing but think about it like this…. If one were to takeover the company, they would also need to take over any debt obligations, so we need add those to the total acquisition cost, but the acquiring company would also receive any cash in the acquired companies treasury, so we subtract that from the total acquisition cost. It is a bit of a confusing concept but hopefully that clears it up a bit.

What are some other relevant metrics?

Sales (Revenue) would work since the sales of DOC and WELL are directly related to their value. An even better metric would be profitability, which can be measured by EBITDA.

Now that we have some relevant metrics, we can determine what multiple(s) we will use.

To start off, we will stick with just using the EV/SALES multiple for simplicity reasons. EV/SALES measures the total value of the company in relation to its sales. To calculate EV/SALES we simply take the Enterprise Value and divide it by the sales.

So now for DOC we have EV/SALES = 9.02x. But we do we do with this number?

Now that we have the EV/SALES multiple for DOC (9.02x), we can compare it to the same EV/SALES multiple of other related companies (the peer group average) to determine if DOC is undervalued or overvalued.

We can see from the table that the PEER GROUP AVERAGE EV/SALES MULTIPLE for the entire peer group (DOC, WELL, JNH, TDOC) is 12.7x.

This means that companies in the peer group are trading for, on average, 12.7x sales.

So let’s take the sales of DOC, which are $39.3M and multiply it by the peer group average of 12.7x. This gives us a relative value of ($39.3M*12.7x) = $498M. So the total relative value of DOC is $498M. If we divide this number by the total number of fully diluted shares outstanding (144M), then we are left with $3.46 per share.

One problem with only using only this EV/SALES number is that it does not factor in profitability to the equation. By using only one multiple (EV/SALES) you are limiting the scope of your model.

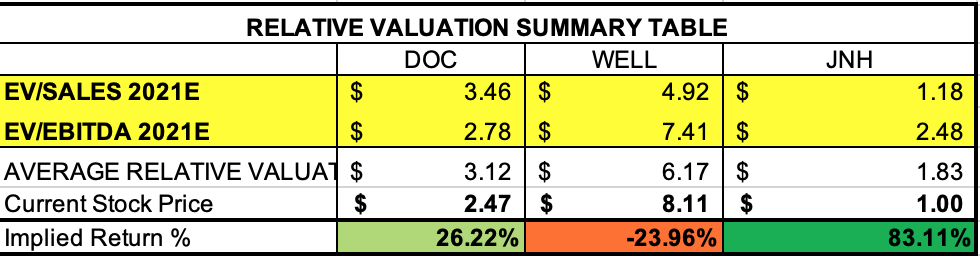

So you can see from the summary table below that I took an average of both the EV/SALES and EV/EBITDA multiples to get a more relevant valuation of $3.12 per share for CloudMD.

EV/EBITDA is a measure of total value in relation to a companies profitability. Therefore, it is actually a better indicator of value than EV/SALES.

The summary table above shows the average relative valuation, the current stock price of each company, and the implied return.

Remember, this is not a fortune telling device, it is a relative valuation model.

What do I mean by that?

Well it means that just because a company is undervalued or overvalued by certain metrics, it does not mean that it is necessarily a buy or a sell. Often times, overvalued companies can stay overvalued until they are eventually acquired for a premium.

Why does this happen?

Because many companies have qualitative factors which quantitative models cannot account for.

For example, if you look at WELL, the reason why there is a premium on WELL SHARES, is largely because of Hamed and Li Ka-Shing’s involvement, the uniqueness of their business model, as well as their first mover status. These are things that are nearly impossible to quantify but will result in a premium on the company’s shares.

So yes, the model shows that WELL is technically overvalued in relation to the peer group. This is not wrong, even expert analysts believe this.

However, analysts also believe this premium is justified and can be sustained moving forward.

Here is a note on WELL from GMP analyst , Justin Keywood .... “

On a valuation basis, Keywood estimates WELL to be currently trading at about 13x consensus EV/2021 sales, which he says is at a premium to its peers but within the range of fast-growing, well-managed peers and generally below US comparables. We believe that a premium valuation can sustain as the business doubles over the next two years with a clean balance sheet, solid management and unique market dynamics of health-tech to support our view.”

So this analyst knows that WELL is trading at a higher multiple, but he believes this can be sustained over time due their unique, advantageous position in the telehealth space.

SIDE NOTE: In other industries, you may need a different multiple. For example, for a junior gold company, they have no revenue or cash flow yet, we cannot use either of these multiples. The value of a gold company is directly related to the amount of ounces of gold the company has in the ground. So, a relevant multiple to use would be EV/total ounces.

- SmallCapInvestor

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Small cap companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.