After a surprisingly good January for the gold sector, the month of February saw a full give-back of January's gains and then some more losses. While some gold juniors did better than others, we saw some real beatdowns across the sector that lasted through the end of PDAC week in early March.

The GDXJ took a nosedive beginning at the end of January that culminated in a selling climax at the end of PDAC week in early March:

One of my larger holdings that I was lucky enough to hold during February's sell-off is Endurance Gold (TSX-V:EDG, OTC:ENDGF). Endurance has delineated what I estimate to be roughly 750,000 ounces of high-grade near surface gold in an epizonal orogenic gold system. The Reliance Project sits at the north end of the Bralorne Gold Camp in British Columbia, an area of western Canada well known for some gaudy gold grades.

The most recent Endurance presentation does an excellent job of explaining the drilling success at Reliance to date, and why the upcoming 2023 exploration program will be so intriguing. Endurance has defined a high-grade near surface gold deposit at the Eagle Zone that currently spans 550 meters of strike extent - the Eagle Zone is at the southern end of what is in total 1,500 meters of gold mineralized strike extent that extends northwest to the Imperial and Diplomat Zones:

Drilling to date in the Eagle Area has produced a 550 x 150 meters gold mineralized area averaging 5.17 g/t gold over 9.6 meters width in 71 RC and diamond drill holes. There is no doubt that Eagle and Imperial are richly mineralized gold zones that must have robust deeper feeder structures. The impressive hit rates in near surface drilling definitely warrants deeper drilling to test plunging feeder zones at depth and along strike (to the SE of Eagle, between Eagle and Imperial, and to the NW of Imperial).

There are several aspects of the Reliance Project that I find to be intriguing, and success in any of these exploration objectives in 2023 will likely result in an rerating higher in the share price:

- Deeper drilling in the Eagle Area to test plunging feeder zones such as the 020 feeder zone that produced a drill intersection grading 15.7 g/t gold over 24.8 meters.

- Drilling at Merit and Crown (between Eagle and Imperial) to connect the two major mineralized areas along strike.

- Drilling to extend the Eagle Area along strike to the southeast.

- Testing the Diplomat Zone to the NW of Imperial and at depth.

Endurance CEO Robert Boyd's stated objective for 2023 in recent interviews and presentations is to drill-define a deposit potentially exceeding 1,000,000 ounces of gold that could be converted into a similar sized 43-101 compliant resource. He has also indicated that he hopes that the 2023 deep drilling will demonstrate the multi-million ounce potential with wider step-outs.

A part of me wonders if some of the sellers who have pounded the stock down from $.40 to $.23 in recent weeks may have focused too much on the “million ounce” statement from Boyd, and not as much on the multi-million ounce potential. After all, it's still way too early to define a resource on Reliance when the system clearly remains open to expansion in multiple directions. Endurance continues to find more high-grade gold and continues to expand the extent of the gold mineralized zones. The approach of growing the system is the correct approach at this time, and there is no rush to define a 43-101 compliant resource.

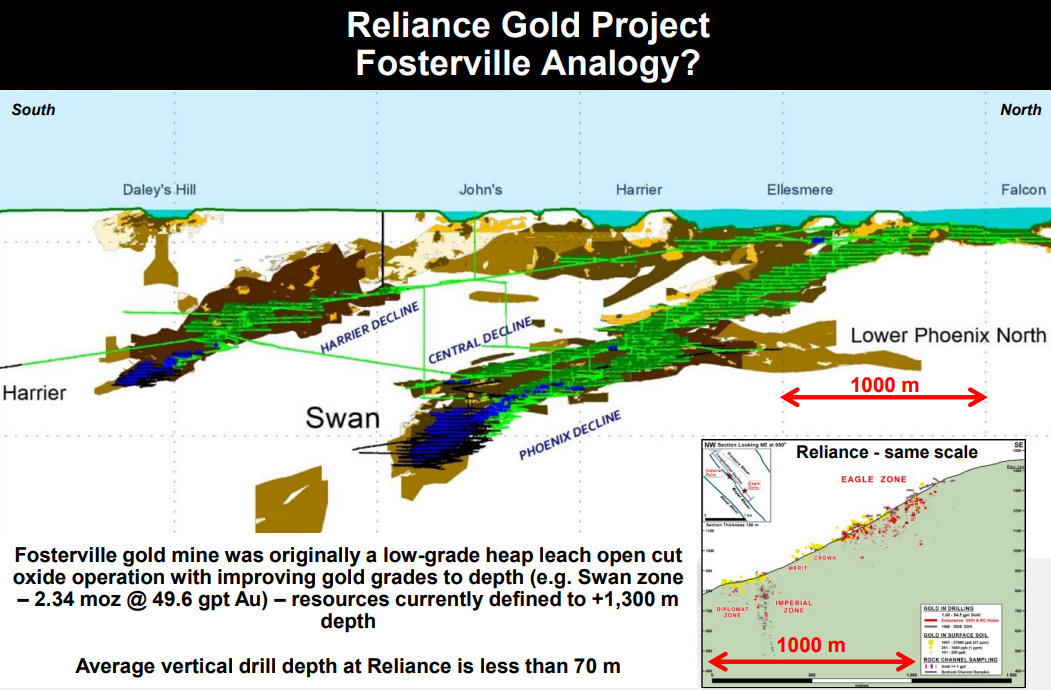

Endurance has inserted a slide demonstrating the analogy to the Fosterville Gold Mine in Australia, another epizonal orogenic gold deposit with notable similarities to the geological setting at Reliance:

Fosterville was originally a near surface open pit oxide and sulphide gold mining operation. The shallower sulphide ores required bio-oxidation for gold recovery. It was only when Newmarket Gold (later Kirkland Lake Gold) began to drill much deeper that the Phoenix Zone with associated coarse gold, and then the incredibly robust Swan Zone were discovered. The Swan Zone alone has generated more than 2,000,000 ounces of gold at roughly 50 g/t gold average grades.

It's clear that Newmarket's success in deeper drilling at the Phoenix and Lower Phoenix zones at Fosterville quickly resulted in the $1 billion takeover offer from Kirkland Lake in 2016 (at a time when gold was trading around $1,300/oz).

Whatever the reason for the recent selling in EDG shares, my understanding is that the sellers' have most likely exhausted their supply of shares for sale. This creates a unique situation in which EDG shares are deeply oversold, and sitting on major support, at a time when the company is a month away from mobilizing its exploration team to site, with drilling due to commence in late April or early May at Reliance.

EDG.V (Weekly)

I understand that Endurance had roughly C$4 million in its treasury at year-end 2022, enough to fund the entire summer of drilling at Reliance. However, with improved market conditions and drilling success I expect that Endurance will expand to two rigs at some point during the summer and that will require topping up the treasury at some point.

Disclosure: Author owns EDG.V shares at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Endurance Gold Corp.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.